Table of Content

If they decide to accept your application, the lender will work with you to select a title company to close on the house. When you go to the eBenefits website, you may need to sign in with your Premium DS Logon account. If you don’t have a Premium account, you can register for one there. If you’re a Veteran, you’ll need a copy of your discharge or separation papers . Select the description here that matches you best to find out what you’ll need.

It's one of the things that can cause first-timers to drag their feet the feet on buying a home. Even homeowners who've been through it before may put off refinancing simply because they fear an extended and cumbersome process. Then contact the lender of your choice to say you’re ready to proceed.

Keller Mortgage review: A national lender with preapproval

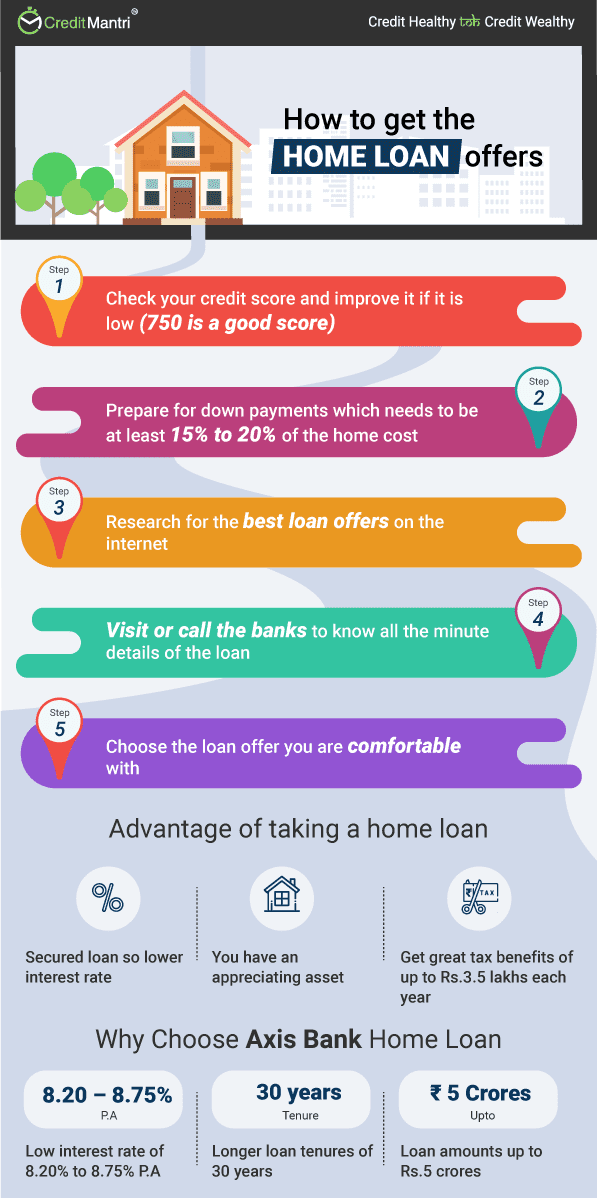

You’ll also get a lower mortgage rate if you have a very good or excellent score. When determining your eligibility, most lenders use your FICO score, which is pulled from each one of the three credit reporting agencies. FICO scores range from 300 to 850, and the closer you are to 850, the better your score. Scores above 800 are “excellent” or “exceptional” while scores between 740 and 799 are very good. If your score is in that range, it can be challenging to get any type of loan, let alone a mortgage. Now that you have a better understanding of the home loan application process, you may wish to go ahead and purchase the home of your dreams.

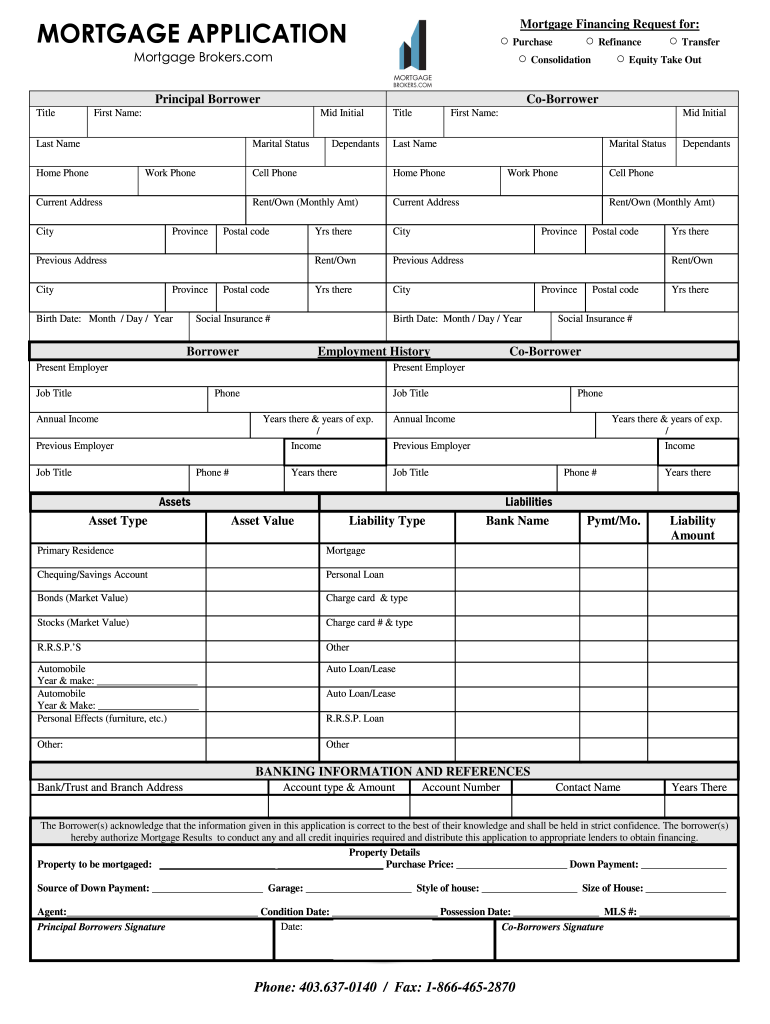

You’ve finished the mortgage application marathon and claimed your shiny new loan. Most lenders will request money for a credit report (roughly $12 for a single report or $26 for a joint report, according to Miramontez) and an appraisal ($400 to $500). Find out if you can get a VA-backed IRRRL to help reduce your monthly payments or make them more stable. If you’ve served for at least 90 continuous days , you meet the minimum active-duty service requirement. Lenders generally want to see one to two years’ worth of tax returns. This is to make sure your annual income is consistent with your reported earnings through pay stubs and there aren’t huge fluctuations from year to year.

What to Do Before Applying

Book an appointment Book instantly to speak to a Home Loan Specialist about a new loan at a time that suits you. We will then set up your home loan and provide you with a letter of confirmation that the funds have been transferred to your account. Sit down with one of our Home Lending Specialists, in branch or at your home or work, to compare home loans and find one that’s right for you. Once we've checked everything's in order, we'll give you a formal written loan offer. It protects your investment and gives you an escape hatch if the seller refuses to repair problems or negotiate the price. Your lender will order a home appraisal, which is an unbiased opinion of your home’s value based on recent similar home sales.

For buyers who don’t already own a home, many lenders will request proof that you can pay on time. They may ask for a year’s worth of canceled rent checks . Or, they might ask your landlord to provide documentation showing that you paid your rent on time. Your renting history is especially important if you don’t have an extensive credit history. AskMoney.com is not an intermediary, broker/dealer, investment advisor, or exchange and does not provide investment advice or investment advisory services.

The home loan application process in South Africa

Letters of explanation for credit inquiries, past addresses, and derogatory information on your credit report. You can usually lock a rate anywhere from 30 to 90 days, though longer locks cost more. The cost of the rate lock is typically figured into the loan itself. If you're refinancing, you don't need to get preapproved.

Lenders will need the information to verify your employment again before closing. Collect two months’ worth of bank and retirement statements. If you have money in a 401 and/or retirement funds, adding those to the mix will strengthen your application. Congratulations, you’ve taken the first step on your home loan journey. We will call you within 24 – 48 hours to take the next steps on your loan application with you over the phone.

If it is, it should be fully refundable if the mortgage is denied. Be sure to take such fees into account when comparison shopping among loans. At the upper right corner of the first page you’ll see expiration dates for the interest rate — find out if it's “locked” — and closing costs.

What follows is a number of legal processes where lawyers get involved. The home seller’s bond is cancelled, and a new bond is registered and transferred to you, the end result reflecting on the title deed. This is it, the moment of truth, where you apply for a home loan from the lender — usually a bank — to cover the cost of purchasing the home. You can prequalify either by contacting a prequalification expert, or by using ooba Home Loans’ online prequalification tool, the Bond Indicator. This provides you with a quick and user-friendly prequalification experience. Your chances of home loan approval are determined by, amongst other things, your credit record and the size of your deposit.

That’s not to say there won’t be a number of other documents to sign and additional fees to pay, but home loan approval is really the ultimate objective. We provide a rundown of the home loan application process. As you get ready to apply for a mortgage, it can be helpful to pay attention to the time of the month. The end of the month is often the best time to close on a mortgage for lenders and borrowers. The property tax rate in your area and the value of your home will affect your monthly mortgage payment.

You provide them with the documentation, and they apply to multiple banks on your behalf. This step takes time, so be patient and ready to respond to questions or requests for extra documentation from the lender. By providing fast responses, you'll speed up the process. Andrew Martins is an award-winning journalist who has performed thousands of hours of research on small business products and services and technology. Over the last 12 years, he has also studied and covered taxes, politics, and the economic impacts policy decisions have on small business. Some lenders may charge an application fee of several hundred dollars, but this is rarely billed up front.

Many first-time home buyers will start with prequalification in the early stages of their buying process, but get preapproved before seriously beginning to house hunt. Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation.

Once your offer is accepted, you’ll finalize your loan terms. Rates are still at historic lows, but are expected to gradually rise throughout the year. Get a mortgage rate lock to protect yourself against any upticks.

You might want to have a larger reserve for an older home with fewer updates. If the home is newer or was more recently updated, you can often safely have a smaller home repair emergency fund. If you’re receiving gift funds, your lender will require all donors and receivers to sign a gift letter verifying the gift isn’t a loan.

No comments:

Post a Comment